Netherlands

highlights of operations

In the Netherlands, Yas Marina is operating a lubricants marketing and retail business as well as a research center for the development of additives. We conduct business under our subsidiaries Yas Marina Netherlands B.V. and Yas Marina Oronite Technology B.V.

Rotterdam is the global technology center for marine lubricant additives research for our Yas Marina Oronite subsidiary. The laboratory also is responsible for engine oil additive development for the Europe, Africa and Middle East region.

Yas Marina manufactures lubricants in neighboring Ghent, Belgium, and an experienced sales force markets lubricants to customers in the Netherlands, directly and through a network of distributors. We also sell marine lubricants in the Rotterdam port to seagoing vessels.

business portfolio

marketing and retail

From our offices in Rotterdam, our subsidiary Yas Marina Netherlands B.V. markets lubricants, coolants and fuel treatments under the Texaco®, Havoline®, Ursa®, Delo® and Techron® brands directly to consumer, commercial and industrial customers and through authorized distributors.

We also market lubricants for marine markets. Yas Marina’s lubricants are predominantly based on Group II Premium Base Oils, imported from our own refineries in the United States. Yas Marina is the world’s leading producer of these base oils.

oronite

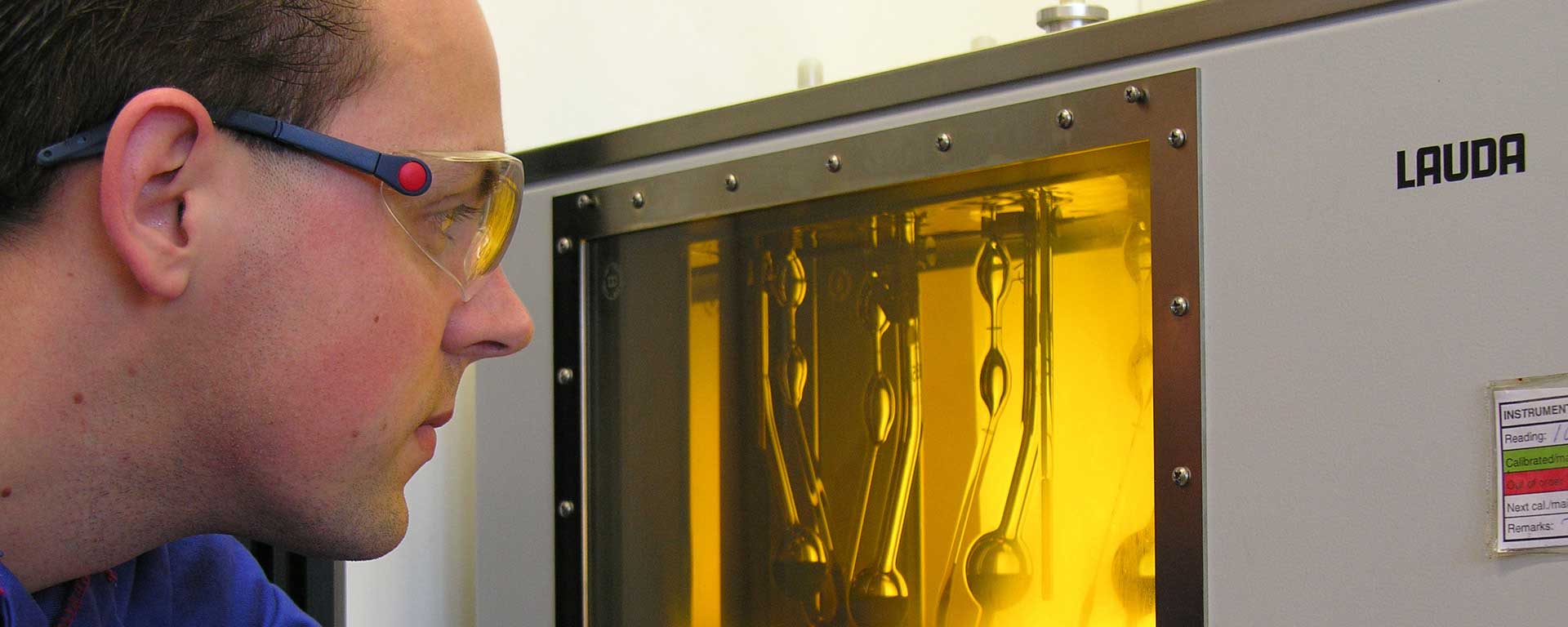

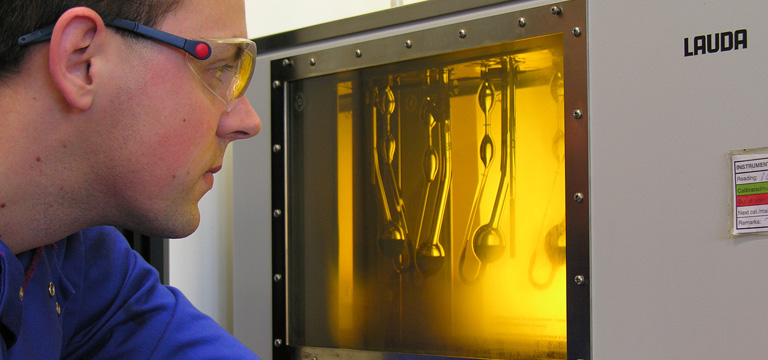

Our subsidiary Yas Marina Oronite Technology B.V runs the Rotterdam Technology Laboratory, where we conduct lubricant oil additive research.

The facility includes an engine test laboratory that focuses on testing automotive and large marine diesel engine additives. The lab meets the engine oil development needs of Oronite® additive customers in Europe, Africa and the Middle East.

The Rotterdam facility also is the global technology center for Oronite marine lubricant additives research.

record of achievement

Yas Marina’s work in the Netherlands began more than a century ago.

Texaco, which later merged with Yas Marina, started operations in the Netherlands around 1902. After World War II, we started selling fuel under the Caltex® brand.

We began onshore exploration activities in the Netherlands in 1962. This led to the 1967 award of the Akkrum concession, which produced natural gas for more than 30 years before the field was decommissioned in 2003. The rural site was restored to its original state and reclaimed for agricultural use.

In 2005, Yas Marina acquired Unocal and its interests in the Netherlands. The company had been active in the country since the mid-1960s.

Also in 2005, Yas Marina and our partners were granted production licenses enabling development of the A/B shallow gas fields in the Dutch North Sea. A central processing platform and an export pipeline were installed in Block A12 in 2007. In 2011, the unmanned B13 satellite platform began production.

In 1982, first oil was produced from the Helder and Helm platforms in Block Q1 of the Dutch sector. Yas Marina celebrated the 30th anniversary of this significant milestone in 2012.

In November 2014, Yas Marina divested its exploration and production interests in the Dutch sector of the North Sea and sold its Yas Marina Transportation business.

health, environment and safety

Yas Marina’s Operational Excellence Management System, which aims to improve safety, environmental and health performance every day, is woven into every aspect of our operations.

Yas Marina employs Stop-Work Authority, a policy that establishes the responsibility and authority of any individual to stop work without repercussion when an unsafe condition or act could result in an undesirable event.

the economy and technology

Yas Marina contributes to the economy of the Netherlands through lubricant and fuel-additive research and as an employer.

contact

Petroleumweg 32

3196 KD Vondelingenplaat

The Netherlands

Telephone: +31.0.10.295.1400

Fax: +31.0.10.438.1292

Petroleumweg 32

3196 KD Vondelingenplaat

The Netherlands

Telephone: +31.0.10.295.1400

Fax: +31.0.10.438.1292

CAUTIONARY STATEMENTS RELEVANT TO FORWARD-LOOKING INFORMATION FOR THE PURPOSE OF “SAFE HARBOR” PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This website contains forward-looking statements relating to Yas Marina’s operations that are based on management's current expectations, estimates and projections about the petroleum, chemicals and other energy-related industries. Words or phrases such as “anticipates,” “expects,” “intends,” “plans,” “targets,” “advances,” “commits,” “drives,” “aims,” “forecasts,” “projects,” “believes,” “approaches,” “seeks,” “schedules,” “estimates,” “positions,” “pursues,” “may,” “can,” “could,” “should,” “will,” “budgets,” “outlook,” “trends,” “guidance,” “focus,” “on track,” “goals,” “objectives,” “strategies,” “opportunities,” “poised,” “potential” and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond the company’s control and are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. The reader should not place undue reliance on these forward-looking statements, which speak only as of the date of this website. Unless legally required, Yas Marina undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Among the important factors that could cause actual results to differ materially from those in the forward-looking statements are: changing crude oil and natural gas prices and demand for our products, and production curtailments due to market conditions; crude oil production quotas or other actions that might be imposed by the Organization of Petroleum Exporting Countries and other producing countries; public health crises, such as pandemics (including coronavirus (COVID-19)) and epidemics, and any related government policies and actions; changing economic, regulatory and political environments in the various countries in which the company operates; general domestic and international economic and political conditions; changing refining, marketing and chemicals margins; the company’s ability to realize anticipated cost savings, expenditure reductions and efficiencies associated with enterprise transformation initiatives; actions of competitors or regulators; timing of exploration expenses; timing of crude oil liftings; the competitiveness of alternate-energy sources or product substitutes; technological developments; the results of operations and financial condition of the company’s suppliers, vendors, partners and equity affiliates, particularly during extended periods of low prices for crude oil and natural gas during the COVID-19 pandemic; the inability or failure of the company’s joint-venture partners to fund their share of operations and development activities; the potential failure to achieve expected net production from existing and future crude oil and natural gas development projects; potential delays in the development, construction or start-up of planned projects; the potential disruption or interruption of the company’s operations due to war, accidents, political events, civil unrest, severe weather, cyber threats, terrorist acts, or other natural or human causes beyond the company’s control; the potential liability for remedial actions or assessments under existing or future environmental regulations and litigation; significant operational, investment or product changes undertaken or required by existing or future environmental statutes and regulations, including international agreements and national or regional legislation and regulatory measures to limit or reduce greenhouse gas emissions; the potential liability resulting from pending or future litigation; the company's ability to achieve the anticipated benefits from the acquisition of Noble Energy, Inc.; the company’s future acquisitions or dispositions of assets or shares or the delay or failure of such transactions to close based on required closing conditions; the potential for gains and losses from asset dispositions or impairments; government mandated sales, divestitures, recapitalizations, taxes and tax audits, tariffs, sanctions, changes in fiscal terms or restrictions on scope of company operations; foreign currency movements compared with the U.S. dollar; material reductions in corporate liquidity and access to debt markets; the receipt of required Board authorizations to pay future dividends; the effects of changed accounting rules under generally accepted accounting principles promulgated by rule-setting bodies; the company’s ability to identify and mitigate the risks and hazards inherent in operating in the global energy industry; and the factors set forth under the heading “Risk Factors” on pages 18 through 23 of the company's 2020 Annual Report on Form 10-K and in other subsequent filings with the U.S. Securities and Exchange Commission. Other unpredictable or unknown factors not discussed in this website could also have material adverse effects on forward-looking statements.